Although much has been said and discussed about the Temporary Solidarity Tax on Large Fortunes (hereinafter “STLF”), this article aims to compile and highlight the most important aspects of this Tax, as well as the possible ways of dealing with it.

In principle, the STLF is temporary in nature, with an initial validity of 2 years, to be applied in 2022 and 2023, after which the Government will assess whether to maintain or abolish it depending on the amount collected. It should be reminded that the Wealth Tax (hereinafter “WT”) was also introduced as a temporary tax, but it is still in force today, although in comparison with the other 27 European Union countries, none other has this type of tax.

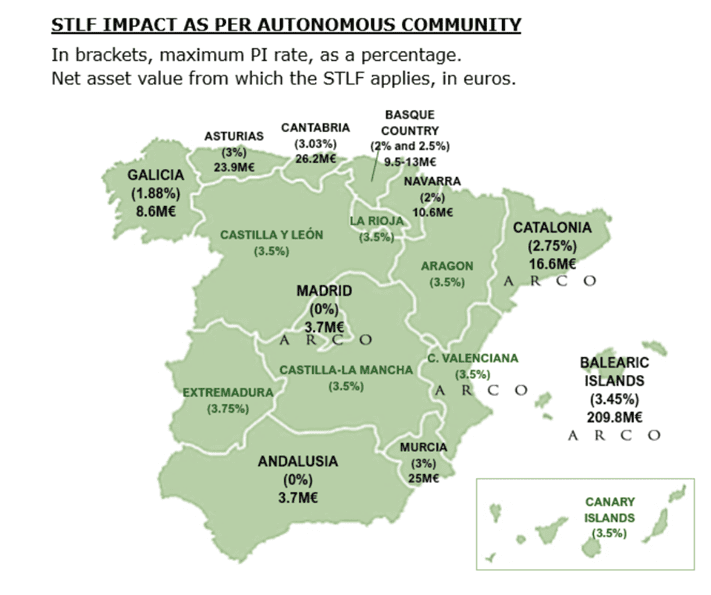

The STLF is proposed as a complementary tax to the WT that applies to assets exceeding €3,000,000 valued on 31 December of each year, for the part that has not been taxed by the WT payable in some Autonomous Communities. The main purpose of this new tax is to harmonise the taxation of WT in Spain, meaning that the Autonomous Communities most affected by STLF are those that grant tax relief or have a lower maximum WT tax rate than the new tax.

It should be recalled that the taxpayers of STLF are the same as those of WT, i.e. individuals who have their habitual residence in Spanish territory and also any other non-resident individuals, as well as residents under the Impatriate Regime (better known as the Beckham Law), for assets and rights located in Spain.

It is important to bear in mind, as a new feature for both STLF and WT, that shares or (unlisted) holdings in foreign entities, 50% or more of whose assets are made up of real estate located in Spain, are considered to be assets located in Spanish territory. Thus, under current rules, non-resident individuals investing in investment funds or any other type of investment vehicle (even if they do not have a controlling interest) that invest the majority of their value in real estate assets in Spain may be taxed under WT and/or STLF.

The STLF Taxable Base is comprised of the value of the net assets, that is to say, all assets and rights minus charges and encumbrances, although for Spanish residents the first €700,000 are exempt.

The tax rates range from 0% to 3.5%.

In contrast to WT, the obligation to file a tax return for STLF only arises when the final tax liability, minus the WT tax actually levied, results in an amount to be paid.

Having described the general framework of the STLF, it merits raising certain considerations in order to try to mitigate its cost:

(i) Some assets and rights are exempt from taxation:

- The main residence is exempt up to €300,000.

- Shareholdings in entities commonly known as family businesses are also exempt provided they meet certain requirements with regard to both the shareholder and the company, which should be verified on an annual basis. In certain Autonomous Communities, the .Inspection Bodies are particularly active in conducting reviews, not only on the application of .the exemption, but also on its scope. For this reason, we recommend checking with special .attention the composition of the asset and its allocation to the economic activity carried out, as having access to this exemption does not mean.having full access to 100% of its scope. In order to adapt this scope, there are formulas that.allow cash surpluses to be used as allocated assets, including, among others, holdings in Venture Capital Companies or other vehicles that invest in .real estate assets, provided that they have their .own organisational structure with sufficient material and human resources.

(ii) The advantages that may arise in these taxes as a result of reducing wealth through gifts or inheritance agreements should be considered, although it is true that the tax impact on other taxes, such as Inheritance and Gift Tax or capital gains in Personal Income Tax, must be taken into account.

(iii) It is also necessary to consider the joint limit of taxation on Income, Wealth and STLF, as this allows for a reduction in the tax payable on the latter two taxes.

(iv) Finally, the door is open to the challenge of the STLF, taking into account that recently (on 21 March and 18 April 2023), the Constitutional Court has admitted the appeals of unconstitutionality presented by the regional governments of Andalusia, Madrid and Galicia (the three Autonomous Communities most affected by this tax). However, it should be noted that the challenge interrupts the statute of limitations for these years, but if the unconstitutionality is upheld, the Court could limit the effects of the ruling (the refund of the taxes paid) to those debts that have been duly challenged.